donation

Everyone deserves a safe and affordable home.

Your donation has twice the value when you utilize tax credits!

We are excited to offer TWO tax credit opportunities for you!

The Neighborhood Assistance Program (NAP), and the (AFHTC) Affordable Homeownership Tax Credit. Both provide a 50% tax credit for your donation.

This makes your donation twice as sweet!

WHO Tax credits are available for any qualified individual taxpayer, small business, or corporation in Indiana donating to Habitat for Humanity.

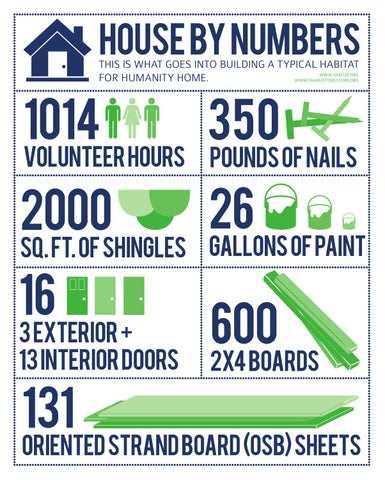

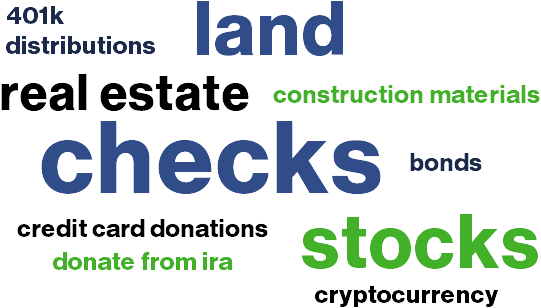

WHAT Tax credits may be used to offset individual income taxes or business taxes in the tax year the donation is made beginning in 2024. Eligible donations may be cash, land, or stock.

HOW The tax credit is equal to 50% of the donation made to Habitat. For example, a gift of $1000 qualifies you for a $500 tax credit on your IN state income tax return. There is a cap of $10,000 in tax credits allowed per tax year, but unused credits may be carried over for up to 5 years!

WHERE Each tax credit program has specific requirements to be met for the credit to be granted.

Contact Becky for details on which program is best for your donation, and the appropriate donation form.